What to make of the January employment report

Raymond James Chief Economist Eugenio J. Alemán discusses current economic conditions.

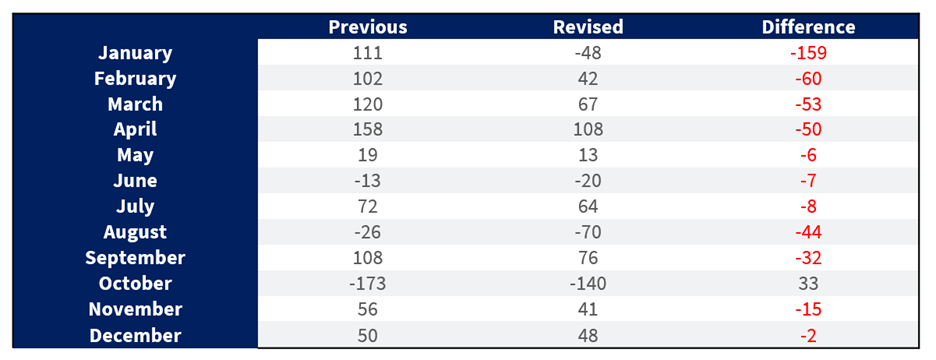

There is a lot to unpack from what was included in the delayed January employment report. The most important information was that it was very strong, up 130,000. Recent research has shown that the breakeven monthly employment growth necessary to keep the rate of unemployment stable is between 30,000 and 70,000 jobs per month. Thus, the January number was very strong according to this research. But the benchmark revision of employment in 2025 showed that the originally published 111,000 increase in jobs in January of 2025 was revised down by 159,000, and now January of 2025 stands at a loss of 48,000 jobs. In fact, the revision in January of 2025 was the largest monthly revision for the whole of 2025, as the table below shows.

For 2025 as a whole, jobs were revised down from an increase of 584,000 to just 181,000, or just 15,000 per month.

The Bureau of Labor Statistics (BLS) also revised its “birth-death model.” If you recall, Federal Reserve Chairman Jerome Powell has mentioned issues with the birth-death model several times during his press conferences after Federal Open Market Committee (FOMC) meetings. According to those comments, the birth-death model has been overstating employment growth. Thus, part of the revision in employment was due to this birth-death model overstatement.

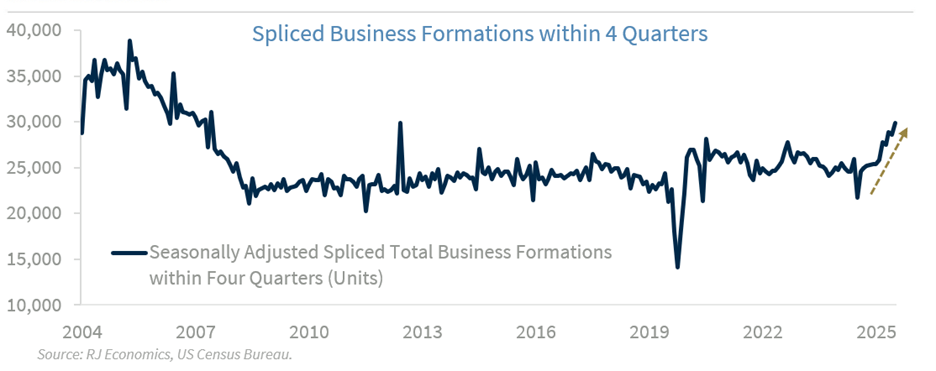

One of the components of the birth side of this birth-death model comes from the US Census Bureau’s estimates of projected business formations. As the projected business formations within the 4 Quarters graph below clearly shows , January 2025 saw a very large decline in projected business formations and thus in projected employment creation from those newly created businesses. However, this series started to move higher in August of last year and has not looked back since. In January 2026, these projected business formations increased by 4.5% compared to December of 2025 and thus should continue to contribute to job growth during this year from these newly created businesses. There is still the possibility that these estimates about new firms being created do not pan out in terms of job creation, but for now, they should continue to contribute to job creation.

Another issue with the labor market today, together with what we wrote on January 16, 2026, has been the Challenger report for January, which showed the largest number of layoffs for the month of January since January 2009. Still, those layoffs have not been recorded in the jobless claims report because most of the companies reporting those layoffs are large corporations that would typically give severance packages to laid-off workers. This means that workers cannot apply for unemployment insurance until those severance packages run out. On the flip side, small businesses typically don’t offer severance packages and, thus, laid-off workers from those businesses apply for unemployment insurance only if they are having trouble finding a new job. But the initial claims series does not show any sign that small businesses are starting to lay off workers at a fast pace and/or if workers are being laid off, they are probably finding other jobs and not applying for unemployment insurance.

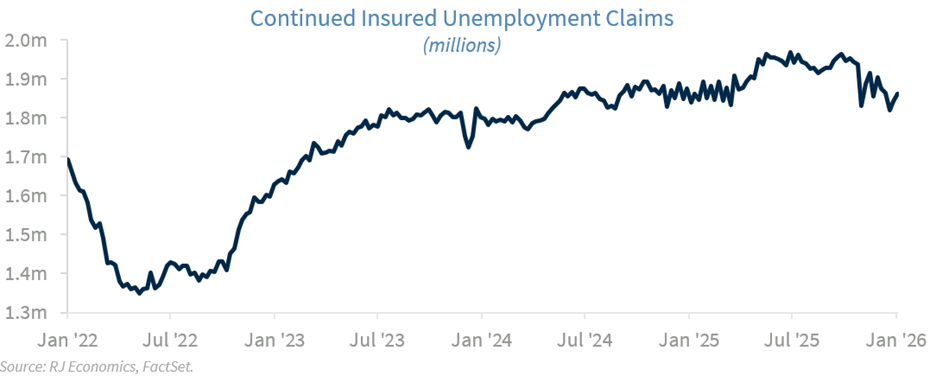

Furthermore, the continued claims series remained on a downward trend at the end of January 2026 (see graph below), showing no signs of a deteriorating labor environment. Typically, continued claims start moving higher ahead of initial claims as the ability of those laid-off workers to find a new job deteriorates. However, there are no signs of that happening today.

Thus, although the labor market weakened considerably last year, our economic growth forecast is expected to be supportive of a recovery in employment creation.

Economic and market conditions are subject to change.

Opinions are those of Investment Strategy and not necessarily those of Raymond James and are subject to change without notice. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. There is no assurance any of the trends mentioned will continue or forecasts will occur. Past performance may not be indicative of future results.

Economic and market conditions are subject to change.

Opinions are those of Investment Strategy and not necessarily those of Raymond James and are subject to change without notice. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. There is no assurance any of the trends mentioned will continue or forecasts will occur. Past performance may not be indicative of future results.

Economic and market conditions are subject to change.

Opinions are those of Investment Strategy and not necessarily those of Raymond James and are subject to change without notice. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. There is no assurance any of the trends mentioned will continue or forecasts will occur. Past performance may not be indicative of future results.